The Size Signals That Predict Whether an Account Is Worth Targeting

Company size alone doesn’t predict deal success. Learn which size-related signals actually indicate buying power, readiness, and outbound viability.

INDUSTRY INSIGHTSLEAD QUALITY & DATA ACCURACYOUTBOUND STRATEGYB2B DATA STRATEGY

CapLeads Team

2/6/20263 min read

Company size feels like a safe filter.

It’s numeric, sortable, and easy to justify.

But size is also one of the most misleading signals in outbound — not because it’s useless, but because it’s often interpreted at face value. Headcount and revenue ranges create confidence without clarity, and that false clarity quietly pulls teams toward accounts that look right but behave wrong.

The accounts that respond aren’t defined by size labels. They’re defined by size signals.

Why Size Labels Create Targeting Blind Spots

When teams filter accounts by “50–200 employees” or “$10M–$50M revenue,” they assume those bands represent maturity, buying power, and internal readiness.

They don’t.

Two companies with the same size label can operate very differently:

One has layered ownership, functional depth, and budget authority

The other is founder-led, resource-thin, and decision-constrained

Outbound struggles when those differences are ignored. The problem isn’t that the ICP is wrong — it’s that the assumptions attached to size are incomplete.

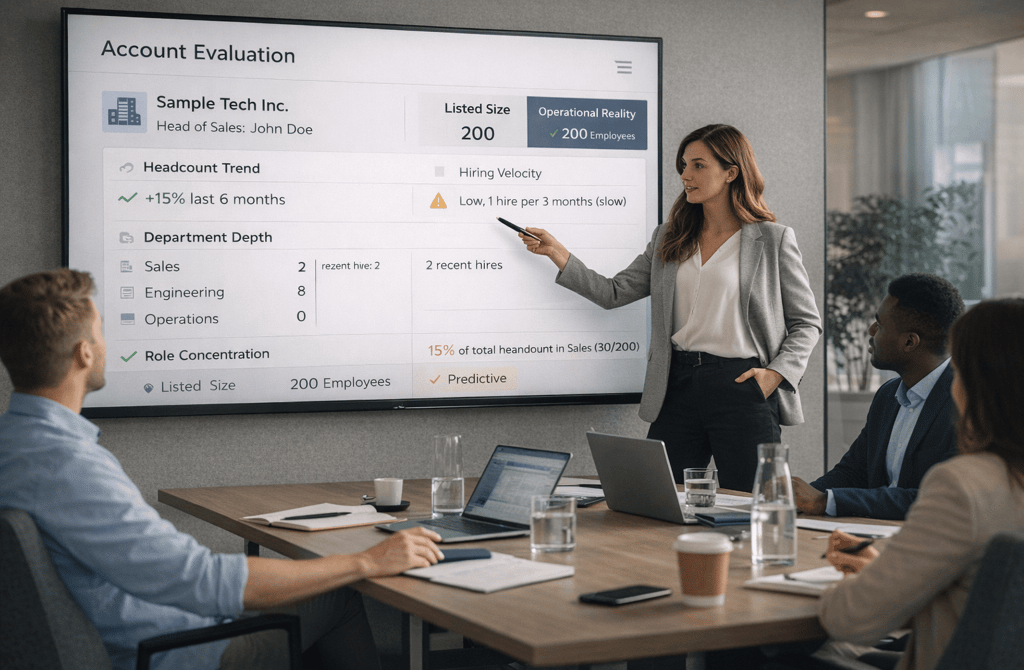

Signal #1: Role Density Reveals Real Capacity

Headcount tells you how many people exist.

Role density tells you how work actually gets done.

An account with 150 employees but only:

One sales role

One ops role

No middle management

will behave like a small company in outbound. Decisions bottleneck. Evaluations stall. Replies slow down.

Accounts worth targeting usually show:

Multiple people in the same function

Clear separation between execution and oversight

Redundancy in ownership

That structure signals capacity to evaluate, not just exist.

Signal #2: Department Balance Beats Raw Growth

Balanced organizations reply differently.

When most employees sit in delivery or engineering, but sales, operations, or finance roles are thin, outbound conversations struggle to move forward. There’s no internal bandwidth to process change.

Healthy targeting signals include:

Presence of non-core support roles

Clear operational ownership

Functional balance across the org

Imbalance doesn’t mean the account is bad — it means it’s not ready.

Signal #3: Hiring Velocity Predicts Engagement Timing

Static size is less useful than movement.

Accounts actively hiring are signaling internal change. Change creates evaluation windows. Those windows produce replies.

When hiring velocity is flat:

Priorities are stable

Attention is inward

External conversations feel low-urgency

Outbound performs better when it intersects with momentum, not stagnation.

Signal #4: Decision Distance Increases with Misclassified Size

Bigger-looking accounts introduce friction.

As perceived size increases:

More stakeholders appear

Decision paths lengthen

Response speed drops

If size is inflated by inaccurate data, outreach targets roles that seem senior but lack authority. Messages don’t get rejected — they get ignored.

That’s how “perfectly sized” accounts turn into silent pipelines.

Signal #5: Operational Maturity Outperforms Revenue Estimates

Revenue data is often estimated.

Operational behavior is observable.

Accounts worth targeting tend to show:

Defined job scopes

Stable reporting lines

Clear functional accountability

These signals indicate readiness to evaluate tools, services, or change. Without them, outbound creates cognitive friction for the recipient — replying requires too much clarification.

Why Size Errors Suppress Replies Quietly

When size signals are wrong:

Messaging feels misaligned

Cadence feels inappropriate

Follow-ups lose urgency

The prospect doesn’t object. They disengage.

From their perspective, responding would require correcting assumptions. Silence is easier.

What This Means for Targeting Strategy

Effective outbound doesn’t chase bigger accounts.

It targets accounts with sufficient internal structure.

That structure shows up through signals — not labels.

Teams that adjust for these signals:

Reduce wasted sends

Improve reply consistency

What This Means

Company size is a proxy, not a truth.

When size signals reflect how an account actually operates, outreach aligns with real buying conditions.

When size is misclassified, outbound mistakes surface scale for readiness — and pays for it in silence.

Accurate size signals make outbound predictable and focused.

Misclassified size data turns targeting into guesswork that looks strategic but fails quietly.

Related Post:

How Bounce Risk Changes Based on Lead Source Quality

The Drift Timeline That Shows When Lead Lists Lose Accuracy

How Decay Turns High-Quality Leads Into Wasted Volume

Why Job-Role Drift Makes Personalization Completely Wrong

The ICP Errors Caused by Data That Aged in the Background

How Lead Aging Creates False Confidence in Your Pipeline

The Data Gaps That Cause Personalization to Miss the Mark

How Missing Titles and Departments Distort Your ICP Fit

Why Incomplete Firmographic Data Leads to Wrong-Account Targeting

The Enrichment Signals That Predict Stronger Reply Rates

How Better Data Completeness Improves Email Relevance

The Subtle Signals Automation Fails to Interpret

Why Human Oversight Is Essential for Accurate B2B Data

How Automated Tools Miss High-Risk Email Patterns

The Quality Gap Between Algorithmic and Human Validation

Why Human Validators Still Outperform AI for Lead Safety

The Duplicate Detection Rules Every Founder Should Use

How Spam-Trap Hits Destroy Domain Reputation Instantly

Why High-Risk Emails Slip Through Cheap Validation Tools

The Real Reason Duplicate Leads Hurt Personalization Accuracy

How Risky Email Patterns Reveal Broken Data Providers

How Industry Structure Influences Email Risk Levels

Why Certain Sectors Experience Faster Data Decay Cycles

The Hidden Validation Gaps Inside Niche Industry Lists

How Industry Turnover Impacts Lead Freshness

Why Validation Complexity Increases in Specialized Markets

How Revenue Misclassification Creates Fake ICP Matches

Why Geo Inaccuracies Lower Your Reply Rate

Connect

Get verified leads that drive real results for your business today.

www.capleads.org

© 2025. All rights reserved.

Serving clients worldwide.

CapLeads provides verified B2B datasets with accurate contacts and direct phone numbers. Our data helps startups and sales teams reach C-level executives in FinTech, SaaS, Consulting, and other industries.