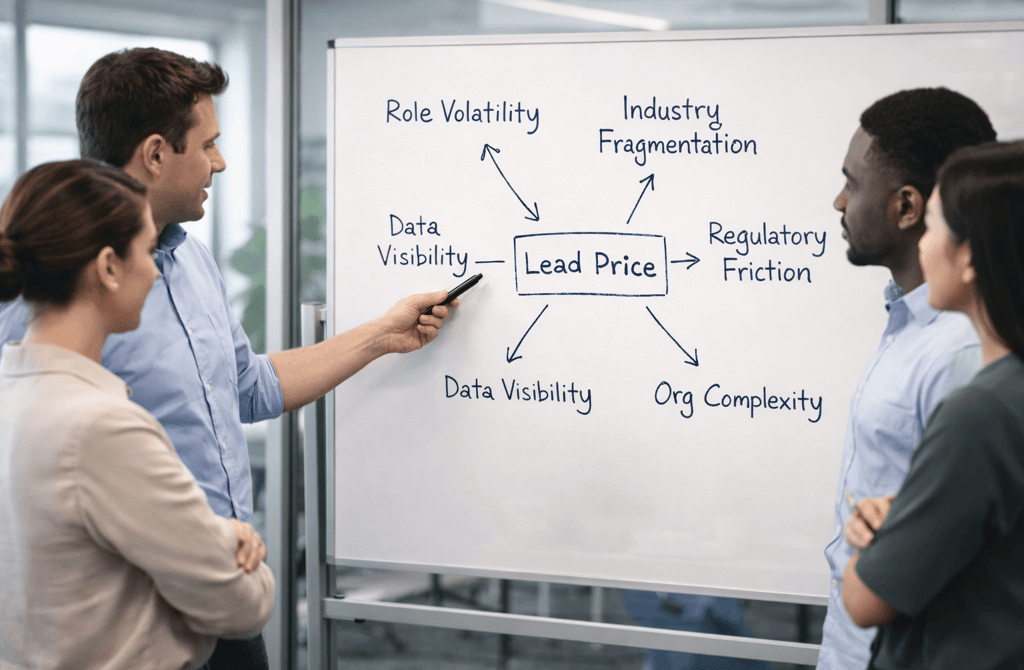

The Cross-Industry Factors That Predict Lead Price

Lead prices aren’t random. Learn the cross-industry factors—role volatility, data visibility, regulation, and fragmentation—that consistently drive lead cost differences.

INDUSTRY INSIGHTSLEAD QUALITY & DATA ACCURACYOUTBOUND STRATEGYB2B DATA STRATEGY

CapLeads Team

1/28/20263 min read

Lead pricing often looks inconsistent until you stop comparing industries and start comparing constraints. When prices rise or fall across sectors, it’s rarely because one industry is more fashionable or another is being “overcharged.” The real predictors sit deeper—inside how information moves, breaks, and resists standardization across markets.

Across industries, the same few forces quietly determine whether lead data is cheap, expensive, or unstable. Once you recognize those forces, pricing stops feeling arbitrary.

Information Visibility Sets the Floor

Some industries leave strong public trails. Companies maintain updated websites, staff publish their roles clearly, and organizational changes are reflected quickly across public sources. In these environments, identifying the right contact is relatively straightforward.

Other industries operate with low visibility by default. Titles are vague, staff lists are hidden, and contact information is intentionally abstracted. This isn’t secrecy—it’s just how the industry functions. When visibility drops, verification effort increases. That added effort sets a higher baseline price long before quality enters the discussion.

Role Volatility Compresses Accuracy Windows

Across industries, role stability varies dramatically. In some markets, people stay in the same function for years. In others, responsibilities rotate constantly due to project cycles, restructuring, or rapid growth.

High volatility doesn’t just make data “older” faster—it shrinks the usable window in which a lead is accurate. Providers must validate closer to delivery, discard more records late in the process, and accept higher failure rates during quality checks. Those losses are absorbed into pricing, even if buyers never see them directly.

Organizational Shape Matters More Than Size

Company size alone doesn’t predict lead cost. Organizational shape does.

Flat organizations with clear reporting lines are easier to map. Layered organizations with regional splits, shared services, or hybrid departments introduce ambiguity at every step. Titles may exist, but authority doesn’t always follow them cleanly.

When authority is hard to infer, lead data requires interpretation, not just extraction. Interpretation doesn’t scale cheaply. Across industries where org complexity is the norm, lead prices reflect that friction.

Regulation Alters Data Behavior, Not Just Access

Regulated industries don’t just restrict data—they change how companies label roles, structure teams, and publish contact details. Compliance requirements often push firms toward generic titles, centralized inboxes, or non-standard reporting lines.

This creates a paradox: data may exist, but it’s harder to confirm relevance. Validation becomes less about confirming existence and more about assessing intent and authority. Industries with heavier regulatory overlays consistently show higher lead costs because the risk of “technically correct but practically wrong” contacts is higher.

Fragmentation Increases Noise, Not Opportunity

Highly fragmented industries look attractive at first glance. Thousands of companies, countless potential leads. But fragmentation often correlates with weak data hygiene.

Smaller operators update records inconsistently, change roles informally, and leave stale digital footprints behind. Automated enrichment struggles in these environments, forcing heavier manual review and higher rejection rates. The more fragmented the industry, the more effort it takes to separate usable leads from misleading ones.

Cross-Industry Pricing Converges on Effort, Not Output

This is where many buyers misinterpret pricing. Two industries may deliver the same number of leads, but the effort required to produce those leads can differ significantly.

Pricing converges around:

How many records fail late-stage checks

How much interpretation is required per contact

How often data must be refreshed to remain usable

Industries that demand more effort upstream will always carry higher prices downstream—even if the final spreadsheet looks identical.

Why These Factors Repeat Everywhere

What makes these predictors reliable is that they appear in every market, regardless of geography or maturity. Visibility, volatility, structure, regulation, and fragmentation consistently explain why certain industries resist commoditization.

Lead pricing doesn’t reward volume alone. It rewards navigability.

What This Means

When lead prices differ across industries, they’re signaling how difficult it is to move from raw information to usable contact data.

Industries that are easier to observe, interpret, and verify naturally support lower-cost lead production. Industries that obscure signals, change roles rapidly, or complicate authority force higher validation effort—and pricing follows that reality.

Clean outreach depends on understanding why some markets are harder to map than others.

Ignoring those structural differences is how pricing surprises turn into performance problems later.

Related Post:

Why High-Pace Markets Produce Faster-Expiring Lead Data

The Decay-Speed Differences Between Tech and Traditional Verticals

The AI Signal Patterns That Predict Lead Reliability

How Machine Learning Improves Multi-Field Enrichment

Why AI-Assisted Verification Outperforms Manual Checks Alone

The Hidden Biases AI Introduces When Data Is Weak

How AI Detects Drift Patterns Before Humans Notice

How Data Reliability Varies Across Industry Segments

Why Some Verticals Produce Cleaner Metadata Than Others

The Industry-Level Factors Behind Lead Consistency

How Vertical Dynamics Shape Data Stability Over Time

Why Certain Industries Generate More Role Ambiguity

How LinkedIn Data Stays “Fresh” Longer Than Email Data

Why Phone Numbers Age Faster in Certain Industries

The Channel Fit Signals That Predict Reply Probability

How Email Bounce Risk Doesn’t Translate to LinkedIn

Why LinkedIn Titles Matter More Than Email Metadata

How Regulatory Environments Influence Data Quality

Why Global Lead Lists Require Region-Specific Handling

The International Data Signals That Predict Reliability

How Country-Level Mobility Impacts Role Accuracy

Why Global Data Drifts Faster in Emerging Markets

How Market Competition Influences Lead Pricing

Why Industry Complexity Drives Lead Cost Variation

Connect

Get verified leads that drive real results for your business today.

www.capleads.org

© 2025. All rights reserved.

Serving clients worldwide.

CapLeads provides verified B2B datasets with accurate contacts and direct phone numbers. Our data helps startups and sales teams reach C-level executives in FinTech, SaaS, Consulting, and other industries.