How Market Competition Influences Lead Pricing

Market competition plays a major role in how B2B lead prices are set. Learn how brokers, large providers, and mid-tier sellers price leads differently—and what buyers should watch for.

INDUSTRY INSIGHTSLEAD QUALITY & DATA ACCURACYOUTBOUND STRATEGYB2B DATA STRATEGY

CapLeads Team

1/28/20263 min read

Lead pricing doesn’t start with spreadsheets or cost-per-lead calculators.

It starts with how many sellers are fighting over the same buyer—and how desperate they are to win that fight.

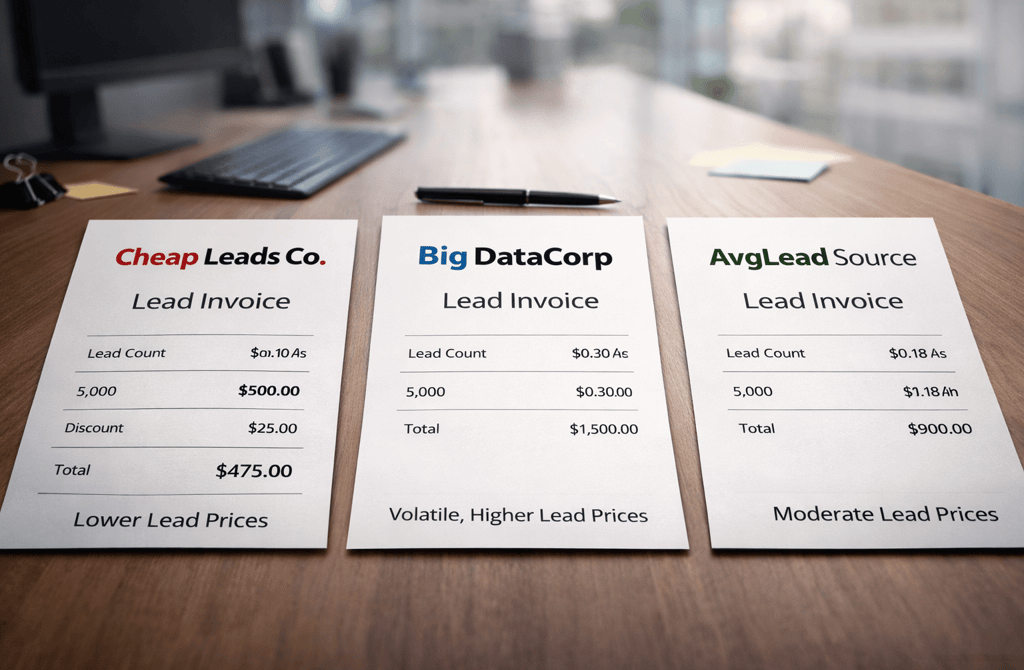

Two datasets with identical lead counts can be priced wildly differently, not because one is better on paper, but because the market behind it behaves differently. Competition shapes pricing long before quality, validation depth, or outcomes enter the conversation.

Pricing Is a Market Outcome, Not a Feature

When buyers look at lead pricing, they often assume prices are set by internal factors: tooling costs, validation effort, enrichment depth. Those matter—but they’re secondary.

The primary driver is competitive pressure.

In markets where many lead providers offer similar datasets, pricing collapses toward the lowest acceptable number. Sellers compete on cost first, differentiation later. Discounts become permanent. “Limited-time pricing” becomes the default.

In contrast, in markets where fewer providers can reliably supply usable data, prices stabilize—or rise—because sellers don’t need to race each other to the bottom.

High Competition Creates Price Volatility

Highly competitive lead markets tend to show three consistent behaviors:

Frequent price changes

Sellers constantly adjust pricing in response to competitors, promotions, or slow demand.Bundled or obscured pricing

Instead of clear per-lead costs, pricing is hidden inside packages, credits, or vague tiers.Lower margins, thinner buffers

When margins shrink, sellers have less room to absorb data decay, replacements, or revalidation work.

This volatility isn’t accidental. It’s structural. When ten providers can source similar data from overlapping inputs, pricing becomes a weapon instead of a signal.

Low Competition Supports Stable Pricing

In markets with fewer credible suppliers, pricing behaves differently.

Prices don’t need to move as often because sellers aren’t constantly undercutting each other. Instead of competing on raw cost, providers compete on confidence: consistency, clarity, and reliability.

This doesn’t automatically mean prices are higher—but it does mean they’re less fragile. Sellers can afford to invest in stronger validation and quality controls because pricing isn’t being compressed every quarter.

Mid-Market Competition Finds the Balance

Most lead markets sit somewhere in the middle.

There’s enough competition to keep pricing honest, but not so much that prices lose meaning entirely. In these environments, pricing tends to cluster around a narrow band. Providers differentiate through service quality, data handling discipline, or niche focus rather than headline discounts.

For buyers, this is often where comparisons matter most—because price differences reflect operational choices, not panic.

Why Buyers Misread Lead Pricing Signals

A common mistake is assuming cheaper pricing signals efficiency and higher pricing signals greed.

In reality, pricing often reflects market structure, not seller intent.

A low-priced dataset might come from:

Heavy competition

High seller churn

Thin margins that limit ongoing validation

A higher-priced dataset might reflect:

Fewer viable suppliers

Higher operational overhead

Lower tolerance for replacement-heavy models

Without understanding the competitive environment, pricing alone tells an incomplete story.

What Smart Buyers Should Look For

Instead of asking “Why is this cheaper?” a better question is:

“What kind of market allows this price to exist?”

Pricing makes sense only in context. The competitive pressure behind the number often explains more than the number itself.

What This Means

Lead pricing isn’t arbitrary—it’s a reflection of how crowded, stable, or strained a market really is.

When competition compresses prices, quality controls tend to stretch thin.

When competition eases, pricing gains room to support consistency instead of shortcuts.

Clean lead data doesn’t come from clever pricing tricks. It comes from markets where sellers can afford to treat data as an asset—not a disposable commodity.

Related Post:

How Vertical Dynamics Shape Cold Email Engagement

Why Some Industries Respond Faster Than Others

The Vertical Factors Behind High-Intent Replies

Why Some Industries Experience Lightning-Fast Data Decay

The Vertical Decay Speed Patterns Most Teams Never Measure

How Industry Turnover Dictates Data Decay Velocity

Why High-Pace Markets Produce Faster-Expiring Lead Data

The Decay-Speed Differences Between Tech and Traditional Verticals

The AI Signal Patterns That Predict Lead Reliability

How Machine Learning Improves Multi-Field Enrichment

Why AI-Assisted Verification Outperforms Manual Checks Alone

The Hidden Biases AI Introduces When Data Is Weak

How AI Detects Drift Patterns Before Humans Notice

How Data Reliability Varies Across Industry Segments

Why Some Verticals Produce Cleaner Metadata Than Others

The Industry-Level Factors Behind Lead Consistency

How Vertical Dynamics Shape Data Stability Over Time

Why Certain Industries Generate More Role Ambiguity

How LinkedIn Data Stays “Fresh” Longer Than Email Data

Why Phone Numbers Age Faster in Certain Industries

The Channel Fit Signals That Predict Reply Probability

How Email Bounce Risk Doesn’t Translate to LinkedIn

Why LinkedIn Titles Matter More Than Email Metadata

How Regulatory Environments Influence Data Quality

Why Global Lead Lists Require Region-Specific Handling

The International Data Signals That Predict Reliability

How Country-Level Mobility Impacts Role Accuracy

Why Global Data Drifts Faster in Emerging Markets

Connect

Get verified leads that drive real results for your business today.

www.capleads.org

© 2025. All rights reserved.

Serving clients worldwide.

CapLeads provides verified B2B datasets with accurate contacts and direct phone numbers. Our data helps startups and sales teams reach C-level executives in FinTech, SaaS, Consulting, and other industries.