Why Some Industries Experience Lightning-Fast Data Decay

Some industries lose lead accuracy far faster than others. Learn which sectors experience lightning-fast data decay and why recency matters more than volume in outbound.

INDUSTRY INSIGHTSLEAD QUALITY & DATA ACCURACYOUTBOUND STRATEGYB2B DATA STRATEGY

CapLeads Team

1/22/20263 min read

Data doesn’t decay at a fixed rate.

It decays at the speed of the industry you’re targeting.

Two companies can buy equally “fresh” lead lists on the same day, run similar outreach, and see completely different results within weeks. One maintains relevance. The other quietly collapses. The difference isn’t execution—it’s how fast the underlying market reshapes itself.

Some industries move so quickly that contact accuracy expires before most teams realize anything has changed.

Data Decay Is an Industry Behavior, Not a Data Problem

Most people think of decay as a technical issue: bad emails, old records, missing fields. But in fast-moving sectors, decay is structural.

Roles shift faster than databases update.

Departments reorganize without announcements.

Decision authority moves laterally instead of upward.

The data doesn’t “go bad” all at once. It becomes misaligned—still deliverable, still formatted correctly, but no longer pointing at the right buyer reality.

That’s what makes fast-decay industries dangerous. They fail silently.

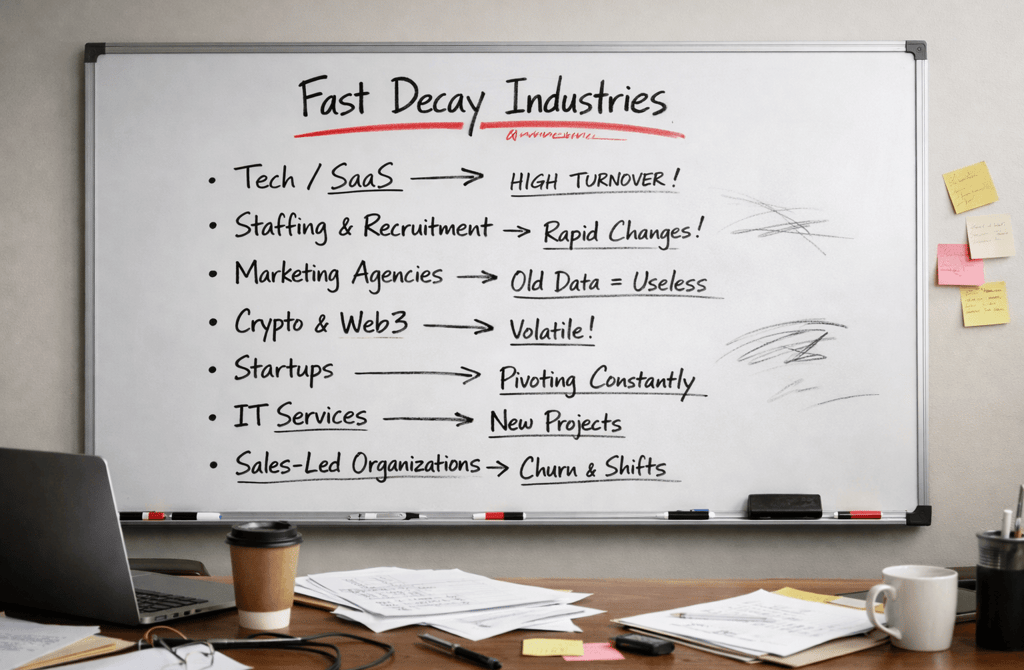

What Puts an Industry Into the Fast-Decay Category

Fast-decay sectors aren’t defined by size or popularity. They’re defined by movement density.

Industries experience lightning-fast decay when they combine several of these forces:

High role churn

In sectors like tech, SaaS, staffing, agencies, and sales-led organizations, people change jobs frequently. Titles evolve, scopes expand, and responsibilities blur. A “Head of Growth” today may not exist in three months.

Organizational volatility

Startups and growth-stage companies restructure constantly. Teams merge, priorities pivot, and ownership shifts internally without external signals. Data becomes outdated even when emails remain valid.

Rapid market shifts

Emerging sectors—crypto, Web3, frontier tech—produce unstable company lifecycles. Businesses appear, rebrand, or disappear at a pace that overwhelms traditional update cycles.

Sales-driven operating models

Industries built around aggressive selling tend to rotate SDRs, managers, and leadership faster. The contact layer is unstable by design.

When these factors stack, accuracy doesn’t erode—it expires.

Why Fast-Decay Data Breaks Campaigns Without Obvious Errors

In slow-moving industries, bad data announces itself through bounces, rejects, or hard failures.

Fast-decay data doesn’t.

Instead, you see:

Lower-than-expected replies

Personalization that feels oddly irrelevant

“No response” patterns across multiple sequences

Engagement metrics that look healthy but go nowhere

The inbox accepts the email. The human ignores it.

That’s because the outreach is technically correct—but contextually wrong. The message reaches a real person who no longer matches the role, authority, or problem being addressed.

Why Traditional Refresh Cycles Don’t Work Here

Many teams refresh lists on fixed schedules: quarterly, monthly, campaign-based. That assumption works only if the industry itself moves slowly.

In fast-decay sectors, fixed refresh cycles fail because:

Role changes happen mid-cycle

Buying authority shifts before follow-ups land

Department ownership changes while sequences are active

By the time performance drops enough to trigger concern, the damage is already baked in.

This is why teams misdiagnose fast-decay failures as copy problems, offer problems, or channel problems—when the root cause is timing mismatch.

The Hidden Risk of Mixing Fast- and Slow-Decay Industries

One of the most common mistakes is blending industries with different decay speeds into a single outbound system.

When fast-decay data is mixed with slow-decay segments:

Performance averages hide failures

Winning segments mask losing ones

Teams scale volume instead of fixing accuracy

Over time, the fast-decay segment drags down infrastructure health, reply curves, and confidence—without ever producing a clear red flag.

How Teams Adapt to Lightning-Fast Decay

Teams that perform well in fast-decay sectors don’t chase perfection. They manage exposure.

They:

Shorten the gap between validation and sending

Treat role accuracy as time-sensitive, not static

Segment fast-decay industries separately

Assume relevance has a shorter lifespan

Most importantly, they stop assuming that “recent” means “usable” across every market.

Bottom Line

Fast data decay isn’t random, and it isn’t avoidable.

It’s a function of how quickly an industry reshapes people, roles, and priorities.

Outbound only becomes reliable when the lifespan of your data matches the speed of the market you’re targeting.

In fast-decay sectors, relevance doesn’t fade—it disappears unless constantly renewed.

Related Post:

The Decisions Automation Gets Wrong in Cold Email

How Human Judgment Fixes What Automated Tools Misread

Why Fully Automated Outreach Creates Hidden Risk

The Outbound Decisions That Still Require Human Logic

Why Outbound Systems Fail When Data Dependencies Break

The Chain Reactions Triggered by Weak Data Inputs

How One Bad Field Corrupts an Entire Outbound System

Why Data Dependencies Matter More Than Individual Signals

The Upstream Errors That Create Downstream Pipeline Damage

Why Some Industries Naturally Produce Higher Bounce Rates

The Vertical Patterns Behind High-Bounce Lead Lists

How Industry Type Predicts Email Bounce Probability

Why Low-Bounce Verticals Offer More Stable Outreach

The Structural Reasons Certain Verticals Bounce More

Why Outbound Behavior Differs Wildly Across Verticals

The Industry-Level Reply Patterns Most Teams Miss

How Vertical Dynamics Shape Cold Email Engagement

Why Some Industries Respond Faster Than Others

The Vertical Factors Behind High-Intent Replies

Connect

Get verified leads that drive real results for your business today.

www.capleads.org

© 2025. All rights reserved.

Serving clients worldwide.

CapLeads provides verified B2B datasets with accurate contacts and direct phone numbers. Our data helps startups and sales teams reach C-level executives in FinTech, SaaS, Consulting, and other industries.