The Revenue Accuracy Problems Hidden Inside Most Lead Lists

Revenue data inside most lead lists is outdated, estimated, or flat-out wrong. Learn how inaccurate revenue ranges distort ICP fit and outbound results.

INDUSTRY INSIGHTSLEAD QUALITY & DATA ACCURACYOUTBOUND STRATEGYB2B DATA STRATEGY

CapLeads Team

12/29/20253 min read

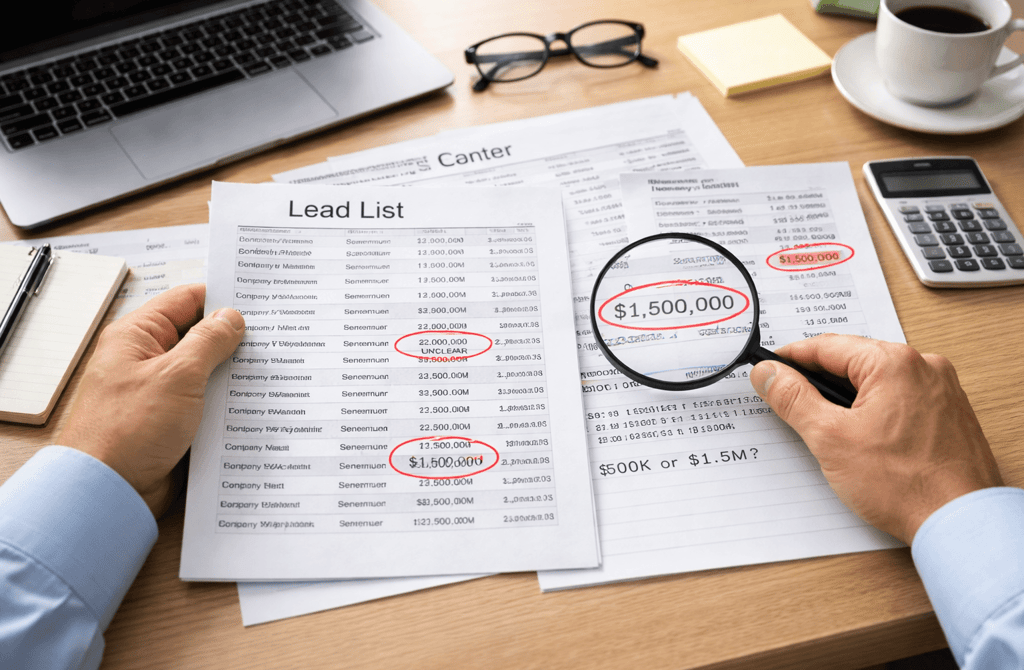

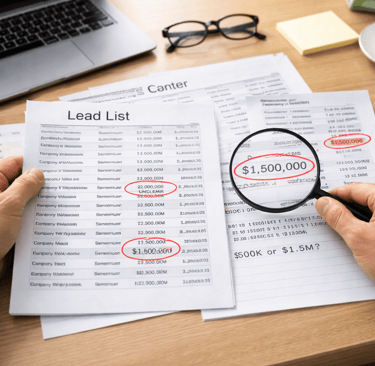

Revenue data is often treated as a convenience field — useful for filtering, but not something teams question too deeply. If a company is labeled “$10M–$50M,” most outbound systems accept it at face value and move on.

That quiet assumption is where many campaigns start going wrong.

Revenue is one of the most error-prone data points in B2B lead lists, and unlike email validity or job titles, its inaccuracies don’t cause obvious failures. Instead, they reshape targeting decisions in subtle ways that weaken results long before teams realize what’s happening.

1. Revenue Data Is Usually Modeled, Not Verified

Most lead providers don’t know a company’s revenue. They estimate it.

Revenue figures are commonly inferred from:

Headcount bands

Public funding disclosures

Self-reported ranges that never get updated

Once a number is modeled, it tends to persist. A company that doubled in size or contracted significantly may carry the same revenue range for years. On paper, it looks stable. In practice, it’s fiction.

Outbound systems treat that fiction as truth.

2. Revenue Errors Reshape Your ICP Without You Noticing

Revenue bands quietly define who “fits” your product.

When those bands are wrong:

Qualified accounts are filtered out

Low-fit accounts are prioritized

Mid-market and enterprise segments blur together

Teams believe they’re targeting a clear ICP when, in reality, they’re operating on distorted boundaries. This is why campaigns can feel directionally correct but never quite sharp.

The ICP didn’t fail — the revenue signal did.

3. Budget Assumptions Leak Into Messaging

Revenue isn’t just a filter. It sets expectations.

Founders and sales teams subconsciously adjust:

Pricing language

Value framing

Risk positioning

Time-to-value claims

When a $3M company is labeled as $30M, outreach assumes maturity, budget flexibility, and buying confidence that simply aren’t there. The prospect doesn’t object — they disengage.

The message isn’t offensive. It’s just misaligned.

4. Revenue Inaccuracy Skews Campaign Learning

One of the most damaging effects of bad revenue data is false learning.

Teams review performance and conclude:

“Enterprise doesn’t reply well”

“Mid-market has low intent”

“Smaller companies convert faster”

But those conclusions are built on mixed segments. Revenue misclassification causes performance data to bleed across tiers, making optimization decisions unreliable.

You don’t just lose replies — you lose clarity.

5. Revenue Drift Happens Faster Than Data Refresh Cycles

Revenue changes faster than most datasets update.

Mergers, funding rounds, customer losses, layoffs, and pricing shifts all move revenue signals rapidly. Static lists can’t keep up, especially when revenue is inferred instead of confirmed.

Over time, lists become snapshots of companies that no longer exist in the same form.

Outbound doesn’t break all at once. It slowly loses precision.

6. Revenue Errors Compound With Other Data Issues

Revenue inaccuracies rarely exist alone.

They amplify:

Company size errors

Role misclassification

Buying committee mistakes

Cadence and sequencing mismatches

Each layer may be slightly off. Together, they create outreach that feels generic, mistimed, or oddly confident in the wrong ways.

Final Thought

Revenue data looks authoritative, but in most lead lists, it’s one of the least reliable fields. When treated as a hard truth instead of a soft signal, it quietly distorts targeting, messaging, and performance analysis.

Clean outbound doesn’t require perfect revenue numbers — it requires knowing how fragile those numbers are.

When revenue is treated cautiously and validated in context, segmentation becomes sharper and decisions become easier.

When it’s accepted blindly, campaigns stay active while accuracy slowly slips out of reach.

Related Post:

Why Incomplete Lead Fields Create Hidden Outbound Waste

The Role Field Enrichment Plays in High-Precision Outreach

How Incomplete Company Data Skews Your Segmentation Logic

Why Enriched Leads Outperform Basic Lists Every Time

The Validation Errors Only Humans Can Catch

Why Automated Checks Miss Critical Lead Risks

The Human Review Advantage Most Providers Ignore

How Manual Validation Fixes What Automation Misreads

Why Blending Human and Automated Validation Wins

The Silent Damage Duplicate Emails Create in Outbound

Why Duplicate Contacts Inflate Your Metrics and Hide Problems

How Spam Traps Enter Lead Lists Without Anyone Noticing

The Hidden Risks Inside “Clean-Looking” Email Lists

Why Risky Emails Ruin Performance Across Multiple Campaigns

Why Industry-Specific Data Validates Very Differently

The Validation Obstacles Unique to High-Churn Industries

How Industry Dynamics Affect Lead Verification Accuracy

Why Some Verticals Require Deeper Validation Than Others

The Validation Rules That Change Based on Industry Type

Why Company Size Errors Break Your Targeting Strategy

Connect

Get verified leads that drive real results for your business today.

www.capleads.org

© 2025. All rights reserved.

Serving clients worldwide.

CapLeads provides verified B2B datasets with accurate contacts and direct phone numbers. Our data helps startups and sales teams reach C-level executives in FinTech, SaaS, Consulting, and other industries.